New Tax Regulation on Cross-border E-commerce Has Released

Write | WBO Team

Translate and Edit | WBO Jessie

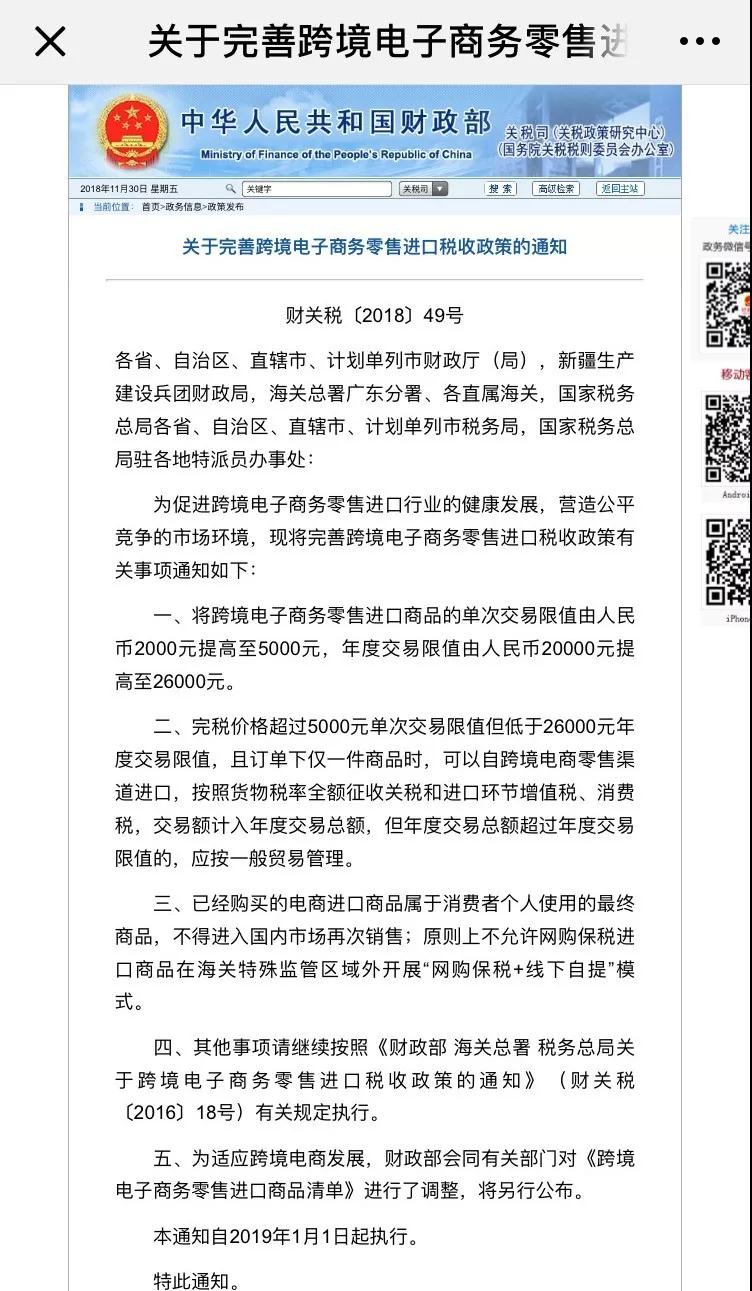

Ministries and commissions jointly issued the Notice on Import Tax Policy for Retail Trade in Cross-border E-Commerce last Saturday.

The circular said that in order to promote the healthy development of cross-border e-commerce retail import and create a fair market environment, it will improve matters related to cross-border e-commerce retail import tax policy, which is going to be implemented from January 1st, 2019.

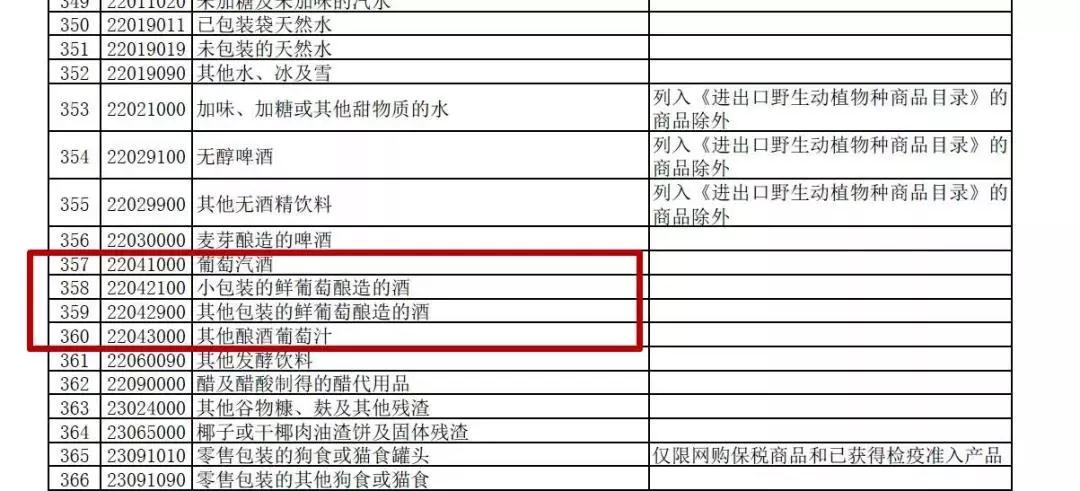

WBO noted that imported wine was included in the list of products related to tariff adjustment published by the Ministry of Finance. Several provisions in the new regulation will benefit imported wines.

Notice shows that the cross-border e-commerce retail import policy will be adjusted. Cross-border e-commerce retail imports limits will be raised from 2,000 RMB to 5,000 RMB for a single transaction, and the annual transaction limit will be raised from 20,000 RMB to 26,000 RMB.

Meanwhile, imported goods purchased in cross-border e-commerce retail channels must not be re-sold in China market. Online bonded imports are not allowed to carry out the “tax free in online purchase + pick up in offline shop” mode outside the special customs regulatory areas.

Customs cross-border e-commerce retail import list issued by Ministry of Finance said that wine and other 1,320 commodities were included in the scope of this adjustment.

After the implementation of the new regulations, it will play a positive role in stimulating domestic demands and expanding imports, and also have a greater impact on cracking down on parallel imports and purchasing agent.

For ordinary consumers, it is more convenient to purchase overseas goods through cross-border e-commerce platform, which objectively promotes the development of cross-border e-commerce.

The limit for a single transaction is raised to 5,000 RMB, which means that consumers who buy online through cross-border e-commerce platforms can enjoy preferential tax limits of 5,000 RMB.

Wine business insiders said that tax burden on consumers to buy high-value products through cross-border e-commerce channels will be greatly reduced after the increase of single transaction limit, and this policy will also facilitate consumption recovery.

At the same time, such adjustment also means that a large number of high-value products can enter the quota.

Wu Yunping, general manager of a cross-border e-commerce platform in Shenzhen, believes that the coverage of each single transaction from 2,000 RMB to 5,000 RMB has expanded, and he can sell First Growth through his platform. This policy is good for high-end wine imports, and will bring some pressure to Chinese super high-end wines.

Zhu Dawei, a cross-border e-commerce operator in Yangzhou, Jiangsu Province, pointed out that this policy is good for the whole medium and high-end goods.

In the field of wines, after e-commerce company pays the cross-border comprehensive tax, imported high-end wines do not need Chinese back label, and the process of providing documents such as certificates of origin for general trade also cut down, which enhances the unit price of customers and expands the market space of home-use wine market.

be

Taxes on the general trade of imported wines include import tariffs, VAT and consumption tax. After such cost added, importing a bottle of European wine has to pay about 46.9% of comprehensive tax generally, while for wines entering cross-border e-commerce platforms, the tax rate is generally drop to 21%.

In order to avoid high taxes, some importers began to sell parallel imported wines.

Generally speaking, parallel imported wine have not went through commodity inspection and paid tariff, also without Chinese back labels. That’s why some importers sold fake wines under the disguise of parallel imports, which caused market disorder in wine industry.

After new regulations were issued, the single transaction limit of imported goods was raised from 2,000 RMB to 5,000 RMB, and the annual transaction limit was raised from 20,000 RMB to 26,000 RMB.

For consumers, this adjustment actually reduces tariffs, and the price of purchases from formal channels will be much lower than before.

Wu said that after the implementation of the new regulations, the tax revenue of formal channel wines has been reduced, and the price advantage of parallel imported wines has been relatively cut down, which has squeezed the space for illegal products ( include parallel imports ), and is beneficial to the replacement of illegal products by legal products.

Wu Xianghua, general manager of Fine West, believes that the new regulation expresses the attitude from the government to benefit ordinary consumers and will certainly boost the purchase of overseas high-end wines through cross-border e-commerce platforms.

The reason why agent purchase and parallel imports have occupied the market for a long time is that the price is lower than wines of regular imports.

But the risk is higher too, when they have bought fake wines, they could only suffer the loss themselves. The new regulation will divert part of the purchase agent, and also have deep impact on parallel imports.

Zhu said, “The more important point is to increase every unit price of transaction from 2,000 RMB to 5,000 RMB, which covers Fifth Growth priced at 300 RMB. This will change the purchase quantity from only 3-4 bottles to one case, and parallel imports from Hong Kong will be replaced by legal e-commerce channel."